Data Analysis, The New Oil

By: Van Leaming

Date: March 7th, 2019

The Past

The Past

Gold and silver, salt and spices, roads and bridges, iron and uranium, data and analysis

Athens, the capital of Greece and the military might of the world, rose to power using their vast silver mines and puppet city-states. The Romans used their vast network of 50,000 miles of roads stretching from Europe to Africa to the middle east to conquer most of the world. Gold and silver, salt and spice, roads and bridges, iron and uranium, data and analysis.

Empires are built on foundational resources of the time. Without roads, aqueducts, and concrete, would Rome go on to conquer and control all the land that they did? Without the riches and a strong military, would Greece be the legend we know today? How about the British without their navy, the Spanish without their gold, the Mongols without the brutality and their horseback archers, Android without tracking customers geographic locations, Facebook without screening your messages for keywords, YouTube without analyzing what videos you watch, and Google without recording your every move.

The Present

The Present

Data is the new oil

We live in a time where data is king. I’m sure you have heard the saying before, but, it’s true. Without data tracking, we wouldn’t have many of the devices, apps, or software that we hold dear. But what is data without refinement?

Clieve Humby, credited as the founder of the phrase “Data is the new oil,” is quoted saying “Data’s valuable, but if unrefined it cannot really be used. Oil has to be changed into gas, plastic, chemicals, etc. to create a valuable entity that drives profitable activity; so must data be broken down, analyzed for it to have value.”

The abundance of data is overshadowed by the potential that the data could provide. Tech empires such as Google, Amazon, Facebook, and Twitter employee thousands to sort all the data they collect and organize it into something they can use. But even with the thousands that they employee, they still can’t make sense of it all.

So what exactly do they have?

You would be surprised by what big tech has on you. Take a guess, 100 documents of information? 1,000? 1,000,000? Seriously, take a guess. You are a resource, untapped and ready to be extracted. Big tech wants to get to know you and they are using every tool at their disposal to do so.

Analyzing your Gmail messages, location tracking on Android devices, recording your search history, and mapping your app usage. You can now request all the information that Google has on you and you won’t imagine how much they have. Dylan Curran from The Guardian requested his data and the file they sent him totaled 5.5GB, which equals 3 million word documents. When I requested my data, Google sent me a file total 9.38GB, which equals 5.1 million word documents. Was your guess correct? Request the information for yourself HERE.

Your messages, your login locations, files you’ve sent and files you have received, how long you spend on your device, your contacts, and your audio files. I requested my data that Facebook stores and it totaled 480mb, equaling around 320,000 documents. Request the information for yourself HERE.

Amazon

The leader in CFE tech (collaborative filtering engine) analyzes your every move and can accurately predict what you will buy next. Amazon refers to the data they have on you as a “360-degree view.” They have everything they need to precisely target you with ads. They can target you down to a 20 to 35-year-old female living in an apartment with an income of $45,000 who enjoys football and biking.

But collecting and analyzing data isn’t all bad. We benefit from it every day. Android services, Gmail services, Amazon products, Google search results, having a Starbucks not too far away but far away enough that’s it’s a little annoying. Everything that we take for granted has ties to data collection and tracking. So how can you jump on the data collection bandwagon and benefit from it? If you are a large business, then I’m sure you deal with this on a day to day basis. Every aspect of most large businesses is controlled by data collection and data analytics.

How can these empires work for you?

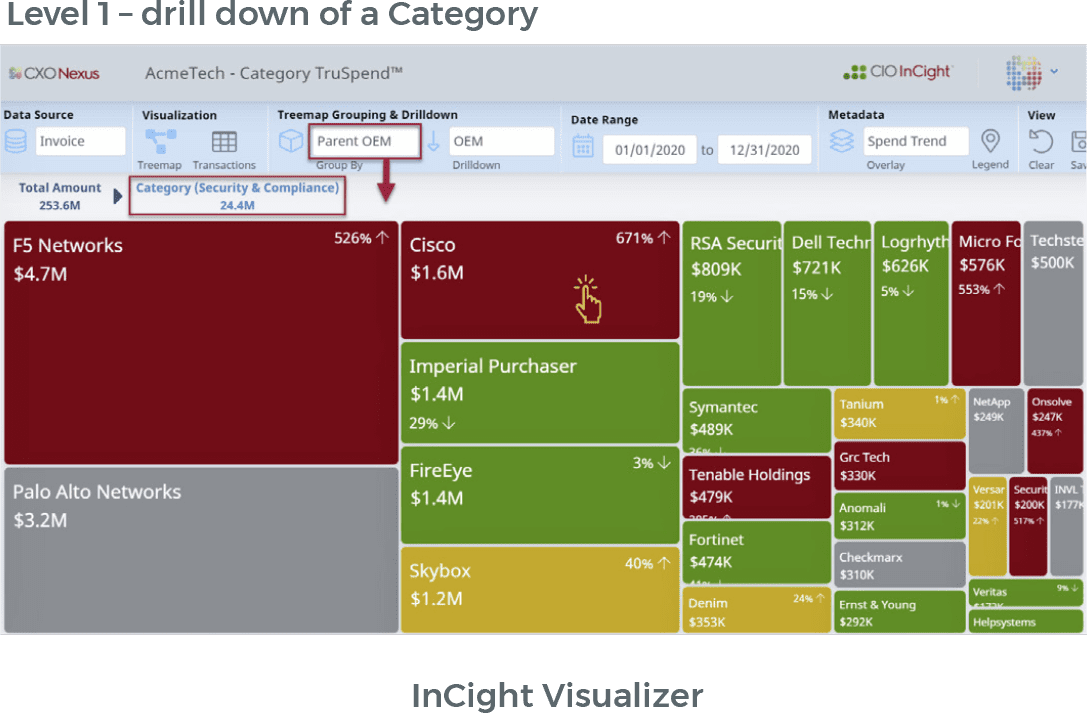

Modern empires are built by data collection and data analysis. Here at CXO Nexus, we take data that your business records and turn it into a valuable commodity. We specialize in managing vendor spend data. Vendor spend data can be hard to analyze due to transaction volume, purchasing through resellers, and data quality. Current financial systems do not have the ability to organize and categorize vendor spend data.

Data management in the C-Suite comes down to understanding how you spend your budget. Our A.I. and machine learning platform attacks this problem of having the data but not knowing how to classify, standardize, and normalize vendor spend. We provide insight into your data by understanding key market dynamics and peer benchmarking through our Visual Fusion Engine™ (VFE™).

We see where data management is going, and it’s going to revolutionize the market place. Data is the new oil. Don’t believe me? Just ask our clients! We have provided value to companies that no other product can offer.

Gold and silver, salt and spices, roads and bridges, iron and uranium, data and analysis.

Here at CXO, we are building on the untapped and ready to be extracted resource of the modern empires, data. Next time you think about how Google, Facebook, and Amazon record your data, think about how Rome and Greece conquered, how the Spanish, the British, and the Mongols prospered. Remember how data is the resource that powers our modern empires.

Send us an email or a LinkedIn message to learn how our AI and machine learning systems are helping companies tackle their data.