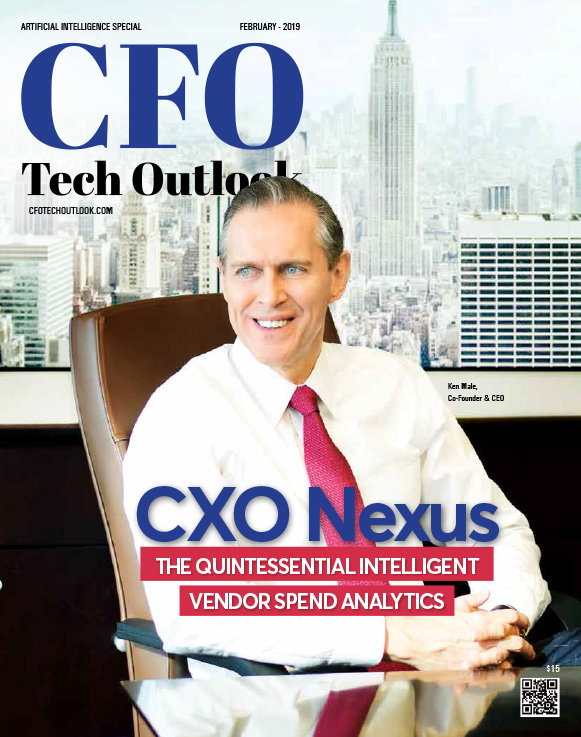

We Made the Cover of CFO Tech Outlook

March 1, 2019

Read the featured cover story

CXO Nexus, Inc. is proud to be named a Top 10 AI provider for 2019 by CFO Tech Outlook magazine and the featured cover story. Read to find out how we leverage AI & Machine Learning to help companies reduce and optimize vendor spend, enable cross-business collaboration and compare to their peers via the use of our Intelligent Vendor Spend Analytics SaaS platform. Thank you CXO Nexus, Inc. clients for the nomination!

CXO Nexus accelerates The Intelligent Enterprise by enabling business leaders to make increasingly smarter and faster decisions while eliminating risk.