Fellow InCighters,

According to McKinsey, an organization’s Vendor Spend represents on average 25 to 40 percent of a merger's total cost-saving potential. Core to achieving this is building the right foundation; a combined spend baseline and taxonomy.

Mapping spend between multiple legacy organizations to a common taxonomy is difficult due to multiple ERP and Procurement Systems, but a must-have to provide a common baseline to achieve sourcing goals across corporate entities. The AI & ML powered CIO InCight® platform provides a system independent overlay that works with all in-place Financial Systems with results that can be provided in fewer than 3 weeks.

With no FTE's or consultants required our automated algorithms categorize spend to a standard taxonomy creating an easy to understand baseline. Companies will often attempt to establish spend comparison reports but are quickly overwhelmed by the transition volume and incompatible taxonomies that have to be manually reconciled.

Our automation categorizes spend to a standard taxonomy, making the baseline a reality, with no FTEs or consultants required. Companies often disregard this basic need, then painfully realize after Day 1 that their definitions of spend for each category are different.

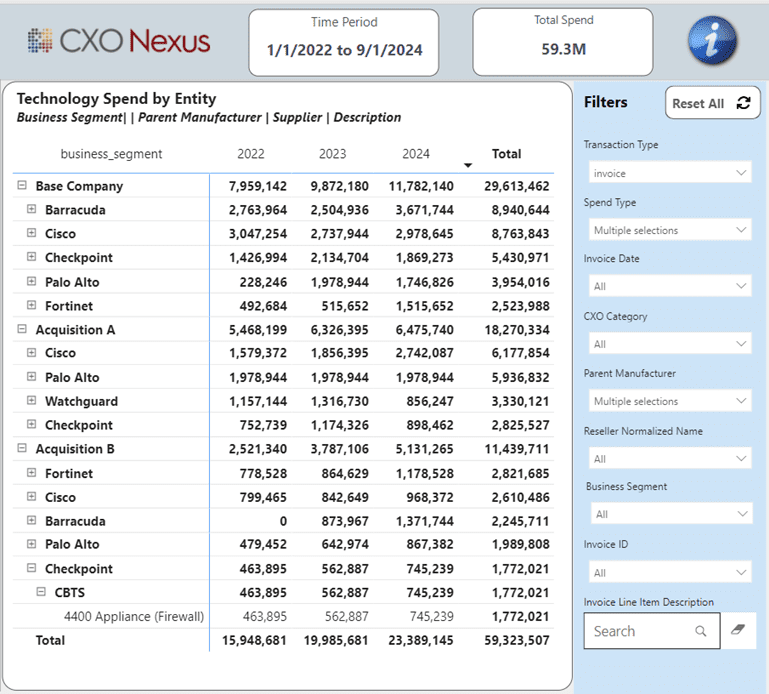

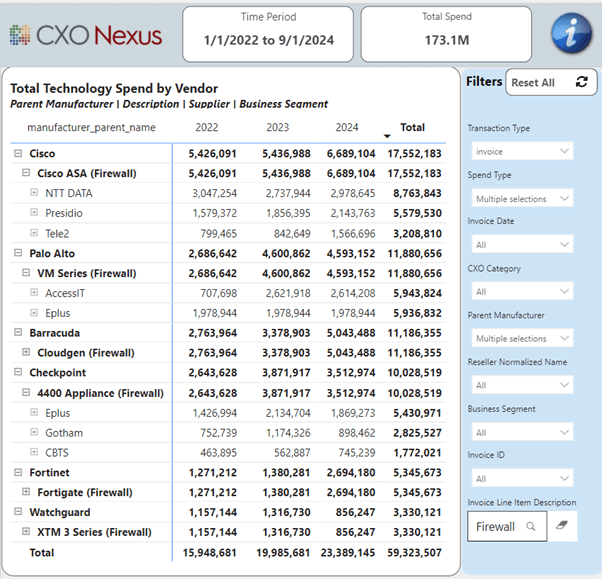

In this standard view of InCight Analyzer (TruSpend® vs AP) we see the data from the in place Financial Systems (right side) that their team would have to try and mine and manipulate for an accurate view into vendor spend. They found it not feasible to; unmask the spend through resellers, deliver OEM parentage and accurately categorize spend. TruSpend (left side) does all of that off the shelf without FTEs or consultants. By "doubleclicking" on the vendor one can drill into OEM Parent, OEM, Supplier and products purchased by individual transaction.

From the Chief Procurement Officer:

“We had two recent significant acquisitions that have defined Vendor optimization targets for spend and vendor consolidation. The estimate to have a consolidated view in our internal reporting systems was almost a year. We would have had to attempt manually aggregating and reconciling the data untill the system migrations were completed.

CXO Nexus was able to provide a consolidated view in weeks via their SaaS CIO InCight. We sent multiple files from various ERP and Sourcing system providers that CXO Nexus was able to scrub, enrich, and load up to a secure dashboard. We did not have the resources to manually combine and cleanse the workable data to identify what InCight delivers out of the box.

Being able to leverage the combined spend across three business entities is paramount to achieving lower pricing. Several key Firewall vendors were initially identified in the Information Security Category higher spend vendors across the three entities that are now merged as one."

Outcomes that Generate ROI:

TruSpend® provides deep visibility into all purchasing

- Captures direct and resell purchases

- Accurate OEM parentage provides negotiation leverage

- Reseller transparency back to OEM

Categorization of spend to standard taxonomy

- Elimination of overlapping technology

- Enables vendor consolidation

Cost center views & M&A activity

- Identifies spend outside of central IT

- Elimination of redundant purchasing

Automation (No FTEs Needed)

- Real time SaaS access via monthly refresh

- Improves productivity: no manual, error prone, point in time “data massaging” activity

From the SVP of IT Finance:

"We started a project team to discover the Technology Firewall spend being purchased but had limited success due to the volume of purchasing done mostly via resellers. With InCight’s intelligent automation the team can now act on the data to eliminate risk and reduce costs via increased leverage and consolidation of both vendors and suppliers to achieve a more homogenous and secure Firewall environment.

Case in point, a wildcard Firewall search identified spend was comprised of six redundant purchasing technologies (Cisco, Palo Alto, Barracuda, Checkpoint, Fortinet, and WatchGuard). Via InCight we have the complete, real-time visibility into our vendor spend, how purchased (direct or indirect), by Cost Center, and Business Entity."

Use Case:

In this video clip, NASDAQ discusses how CIO InCight unmasked their reseller spend. Key to unlocking the TruSpend of a manufacturer.

Have questions?

We can help you in researching specific vendor spend. Send an e-mail to support to request assistance from a Customer Success representative.

If you have issues signing in, contact us.

Best,

Leif

Leif Easterson

Leif Easterson

Global Head Customer Success

LEasterson@cxonexus.com

Transforming Data to InCight®

Customer challenges and insights gained by using CIO InCight.

Each one is a chapter in discovery, finding hidden details of the vendor spend data ingested. Our ML & AI-driven Intelligent Fusion Engine IFE® is used to clean and normalize down to the item level and will reveal actionable information.